According to economist and former Deputy Minister of Economy Nikoloz Alavidze, the lari has gained some of its value due to the weakening of the US dollar caused by the tariff policy announced by the new US administration.

In a conversation with Commersant, Alavidze says that despite many decisions have not yet entered into force, global markets are already responding: in America, stock market capitalization has fallen to $6 trillion, and company expectations point to signs of a recession. Such fluctuations pose a direct threat to Georgia's small economy, which depends on global markets.

"The lari’s strengthening is driven by a significant US dollar weakening against currency pairs. This process is part of the policy of the new administration, I can’t say that they are doing this on purpose, but this is the result of the initiated tariff war, which has only been declared so far, because many decisions have not yet entered into force. Changes will be reflected in the global markets in at least 3-6 months and will definitely have a negative effect. In the United States alone, the markets have adjusted by about 6 trillion, the managers of their largest companies expect a recession in the country that is very bad for the global economy, of which we are a part.

It is very difficult for such fluctuations in the global economy not to affect the local economy; the main thing is in what time frame. We have a small economy and is easy to manage if it is done properly.

It is one thing what statistics tell us, and quite another what reality shows. Current events in the international market also affect our exports and imports. "This is not a one-day or two-day process, but international events and the tariff war will also affect the Georgian economy," Nikoloz Alavidze notes.

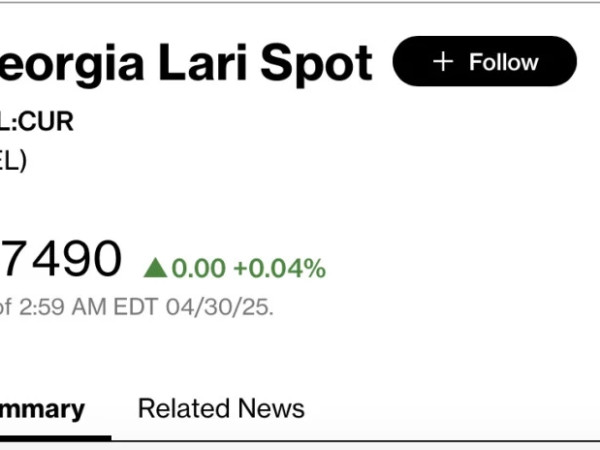

Note: as a result of trading on May 1, the Georgian national currency strengthened by 0.05 tetri against the US dollar and the official exchange rate was set at 2.7487 GEL.