The decision of the National Bank of Georgia to leave the refinancing rate unchanged was an expected decision, which is determined by both domestic economic indicators and global factors, Otar Nadaraya, chief economist at TBC Group, said in an interview with Commersant.

According to him, while inflation is close to target, it is under pressure from several factors: the ongoing conflict in the Middle East, the risk of rising oil prices, and this year, inflation could be further pressured by domestic factors, namely expected low yields.

"Leaving the refinancing rate unchanged was expected. The arguments in favor of not lowering it were the current events in the Middle East, although even without this we expected that the refinancing rate would remain unchanged due to high economic activity and inflation close to target although growing. However, our rate depends on the US rate where a decision to cut has not yet been made."

"The current events in the Middle East contain inflation risks that affects oil prices, which could become even more large-scaled. In addition, we will not have a good harvest this year, and this will also affect inflation," Otar Nadaraya notes.

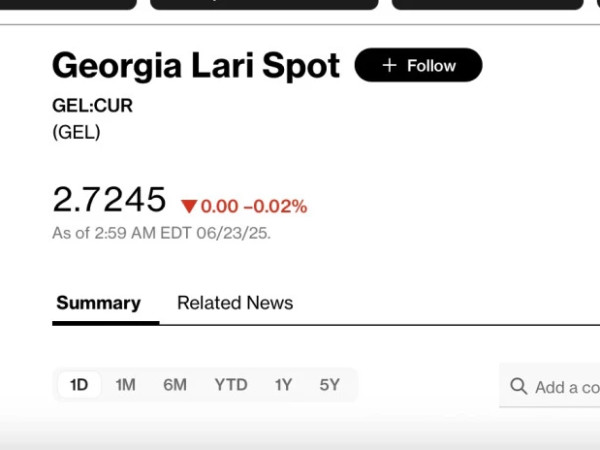

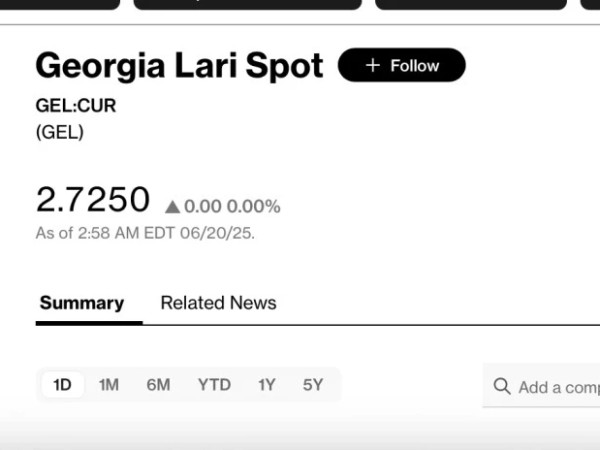

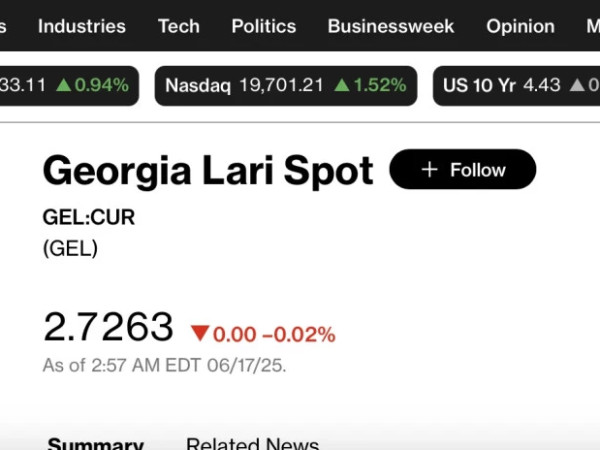

According to the chief economist of TBC Group, despite global and domestic risks, the current dynamics are clearly an argument in favor of strengthening the lari. There are challenges, no one knows how events will develop in the Middle East, but the current dynamics favor the lari. The county already sees a decline in tourist flows, but there is another question concerning migration.

In general, the escalation in the Middle East is already very noticeable. We should hope that the active phase of the conflict will end soon, but unfortunately there are no signs of that yet.

"So far, our forecast is as follows: inflation by the end of the year will stood at 4.5%, that means that until December the inflation rate will be slightly higher, and then it will start declining.

"If inflationary pressure increases, which is not excluded , we think the lari will strengthen even more. There is a huge excess supply of dollars on the currency market, and NBG is byuing reserves in record volumes, so if the pressure continues, the lari will strengthen, even slightly," Otar Nadaraya stresses.